Total Debt to Equity Ratio (D/E Ratio)

The Debt to Equity Ratio is used to evaluate a company's financial leverage. It calculates the weight of total debt and financial liabilities against total shareholders' equity.

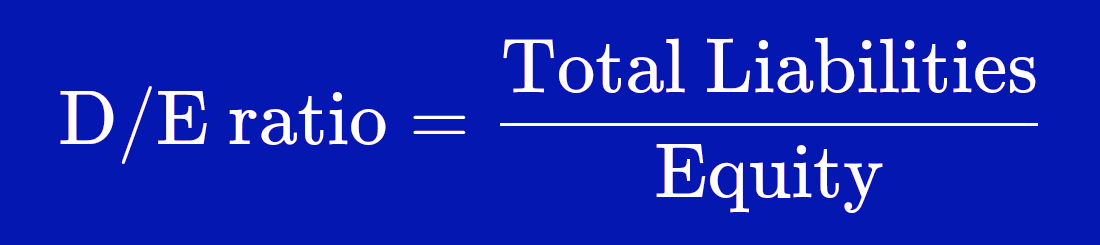

Formula

Total Liabilities / Total Shareholders' Equity

What does it tell you?

It reflects the ability of shareholder equity to cover all outstanding debts in the event of a business downturn.

Interpretation

High D/E Ratio

A high ratio indicates that a company has been aggressive in financing its growth with debt. This can result in volatile earnings as a result of the additional interest expense. If the ratio is too high, the company is at high risk of insolvency or bankruptcy.

Low D/E Ratio

A low ratio means the company is more financially stable and uses less debt to finance operations. Investors generally prefer companies with lower D/E ratios as they are less risky.