Earnings Per Share (EPS)

Earnings Per Share (EPS) is the portion of a company's profit allocated to each outstanding share of common stock. It serves as an indicator of a company's profitability and is a key driver of stock prices.

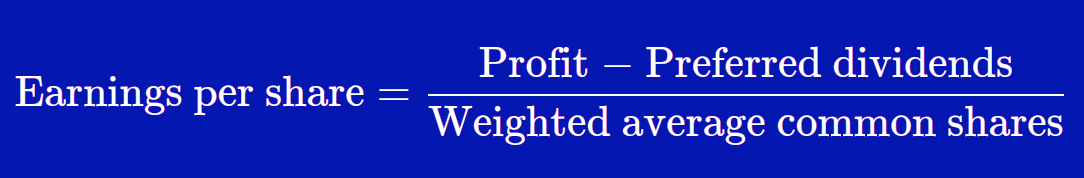

Formula

(Net Income - Preferred Dividends) / End-of-Period Common Shares Outstanding

Interpretation

Higher EPS

A higher EPS generally indicates greater value because investors will pay more for a company with higher profits. Consistent EPS growth year-over-year is a very positive sign of a healthy, growing company.

Lower or Negative EPS

A low EPS relative to peers suggests the company is less profitable per share. A negative EPS means the company is losing money (Net Loss).

How to Use It

Tip: Look for companies with consistently increasing EPS over several years (e.g., 5-10 years).

This makes the company's growth predictable and often leads to share price appreciation.

Risks

Warning: Companies can manipulate EPS by buying back their own shares (share buybacks), which reduces the number of shares outstanding and artificially boosts EPS without increasing actual earnings.

EPS also ignores debt and the capital required to generate earnings.