Price to Book Value Ratio (P/B Ratio)

The Price to Book Value Ratio (P/B Ratio) compares a company's market capitalization to its book value. It is used to identify whether a stock is undervalued or overvalued.

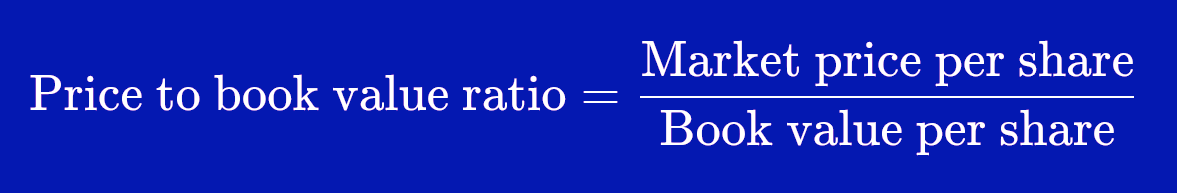

Formula

Market Price per Share / Book Value per Share

What does it tell you?

It reflects the value that market participants attach to a company's equity relative to the book value of its equity.

Interpretation

High P/B Ratio

A high P/B ratio suggests that investors expect high future growth and are willing to pay a premium for the company's assets. However, it could also mean the stock is overvalued.

Low P/B Ratio (< 1.0)

A ratio less than 1.0 can indicate that the stock is undervalued, meaning it is trading for less than the value of its assets. However, it could also signal that the company is in financial trouble or earning very low returns on its assets.