Price to Cash Flow Ratio

The Price to Cash Flow Ratio is a valuation metric used to evaluate the price of a stock relative to its operating cash flow per share.

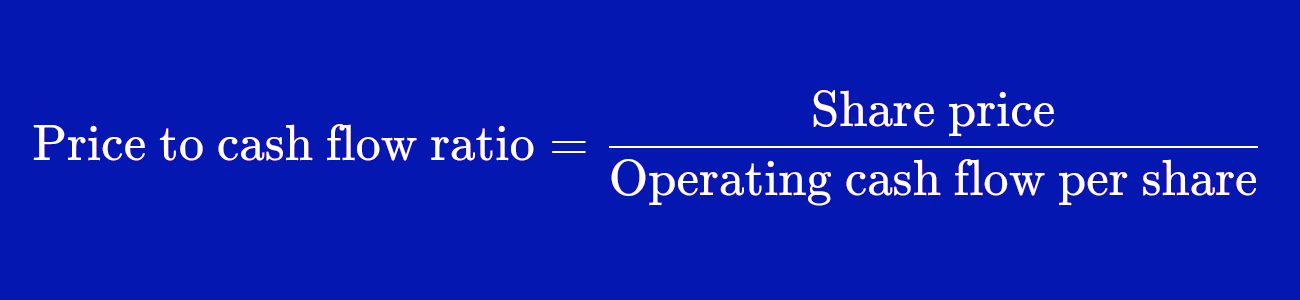

Formula

Current Share Price / Cash Flow per Share

Why is it Better than P/E?

The Price to Cash Flow ratio is often considered a better investment valuation indicator than the P/E ratio because:

- Cash flows are harder to manipulate than earnings figures (which can be affected by depreciation and other non-cash items).

- Cash flow represents the actual cash generating ability of the company, which is crucial for solvency.

It is typically calculated using the trailing 12-month (TTM) data.

Interpreting the Ratio

High Ratio

A high ratio implies the stock is trading at a premium. The company may be overvalued or simply not generating enough cash relative to its price.

Low Ratio

A low ratio suggests the company is undervalued and might be a good investment. If a company generates plenty of cash, it has better prospects for growth and dividends.

How to Use It

Tip: Look for shares with a low Price-to-Cash Flow Ratio compared to their industry peers.

This ratio is especially useful for evaluating stocks with large non-cash expenses like depreciation.

Risks

Warning: A very high ratio compared to the industry can indicate high risk.

Also, do not specific reliance on this ratio if the company has positive cash flow but excessive non-cash expenses that might mask underlying unprofitability in accrual terms.