Book Value Per Share

Book Value Per Share (BVPS) measures the book value of a firm on a per-share basis. It represents the minimum value of a company's equity for each share of common stock.

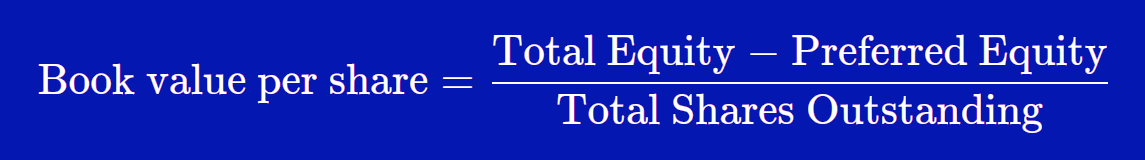

Formula

(Total Shareholders' Equity - Preferred Equity) / Total Outstanding Shares

What does it tell you?

It helps determine the level of safety associated with the stock price. If a company is liquidated, this is roughly what common shareholders could expect to receive per share (assuming assets can be sold at their book value).

Interpretation

Share Price < BVPS (Undervalued?)

If the market price is lower than the book value per share, the stock might be undervalued. Investors often see this as a buying opportunity, assuming the company's assets are not impaired.

Share Price > BVPS

Typically, healthy companies trade at prices higher than their book value because investors expect future profit growth and value intangible assets (brand, IP) not fully captured in book value.