Current Ratio

The Current Ratio is a liquidity ratio that measures a company's ability to pay short-term obligations or those due within one year.

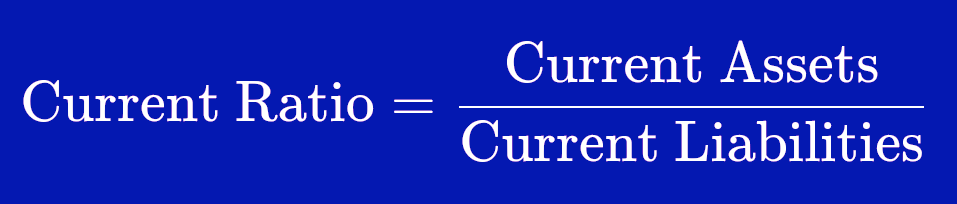

Formula

Current Assets / Current Liabilities

What does it tell you?

It tells investors how a company can maximize the liquidity of its current assets to settle its debt and other payables on time. It is a key indicator of short-term financial health.

Interpretation

Higher Current Ratio (> 1.0)

A ratio greater than 1.0 indicates that the company has more current assets than current liabilities. This suggests good short-term financial strength and the ability to pay off debts easily.

Lower Current Ratio (< 1.0)

A ratio less than 1.0 indicates that liabilities exceed assets. This can be a warning sign that the company may struggle to pay its short-term debts.

How to Use It

Tip: A current ratio of 1.5 to 2.0 is often considered healthy.

Compare the ratio to industry averages, as "normal" varies by sector.